Today another take-private announcement with Bain Capital capital bidding for SoftwareOne

YTD – in Europe – we have seen more take-private announcements than #ipos (companies with capitalisations >100m$) !!!

What is driving this trend?

Several factors. De-equitisation is not a new topic.

Currently one argument is that public valuations are lower than in private markets. Fair. Public markets are more liquid and they logically adjust faster for the higher cost of capital. A better place to go shopping and spend PE dry powder or corporate cash.

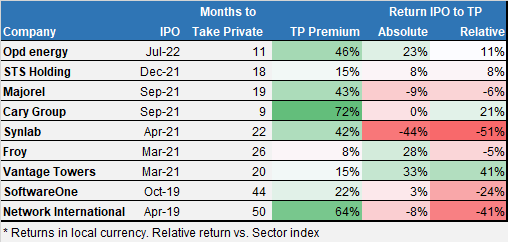

But looking closer at the companies being taken private, it strikes us that a high proportion comes from recently listed companies. See illustrative table below.

Could it be the case that public investors fail to properly value recently listed companies ? If so, why?

Is it because companies fail to build the right – supporting – shareholder base at IPO? If so, why ?

The chance that you become an unattractive stock is higher if you fail your IPO.

Or are IPOs priced too high and not structured in a way to favor aftermarket buying activity? If so, why ? 📉

Yesterday, WE Soda decided to pull its London listing. Pointing to extremely cautious investors about IPOs.

All IPOs executed in Europe YTD started their listing journey by trading below their offer price….📉And you cannot blame the market, it is up 9% in Europe YTD 📈!! So maybe it is a fair reason to be cautious?

Amundsen Investment Management has a mandate to select and support IPOs globally. We are regularly being asked what needs to be done differently so that more IPOs come to market in Europe 🇪🇺🚀🏦

A vast topic to be adressed 🛠️

Recent Comments