This week, we will discuss the financing of the Energy Transition at EDP, one of the world’s leading renewable energy developers and operators on IPO Stories. The IPO of EDPR dates back to 2008, and it was part of the early wave of pure play energy transition companies listing. Looking back to 2010, the universe was made up of some renewable energy developers (EDP Renewables, but also EDF Energies Nouvelles – listed in 2007, Enel Green Power, listed in 2010…), OEMs (Vestas, Gamesa Electric), as well as some others (e.g. TOMRA in recycling).

With the low number of listed companies, most clean energy fund portfolios looked very similar.

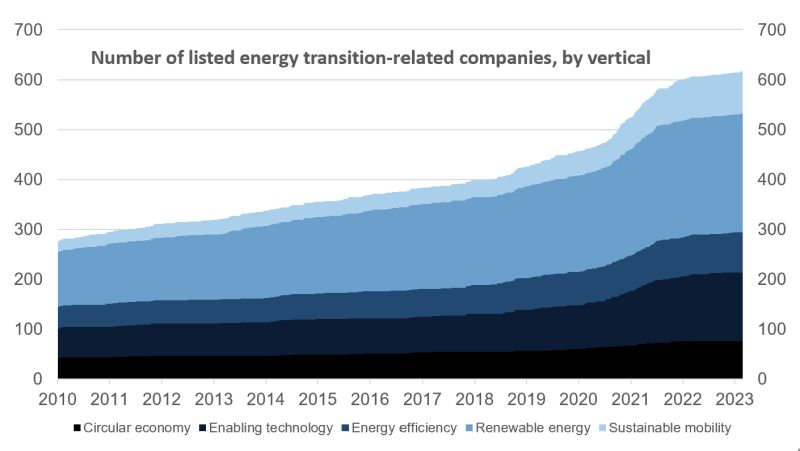

Through the IPOs and spin-offs over the last 10 years, we now count more than 600 listed companies contributing to the energy transition globally, representing $5tn of market capitalization. The breadth of companies has widened substantially, with many new entrants in the sustainable mobility, battery and hydrogen sphere.

In addition to providing funding for the companies, the IPO has the positive externality of increasing the breadth of the investment universe for asset owners. With such an increase in breadth, I am still surprised by the extremely narrow universes of today’s leading energy transition indices (S&P Clean energy: 99, MSCI Alternative energy: 94).

Recent Comments